Real estate professionals typically earn 2.5%–3% per side of a sale, but after broker splits, fees, and taxes, take-home pay often drops below 1.5%. With 2025 rule changes, buyers may pay agents directly, making commission strategy more critical than ever.

At a Glance: Real Estate Commission Breakdown (2025)

- Typical commission per side: 2.5%–3%

- Total deal commission (buyer + seller): 5%–6% (paid by seller)

- Agent/broker split: Often 70/30 or 80/20

- Your take-home after split on $12K? ~$8,400 before expenses

- What reduces your earnings: Franchise fees, desk fees, E&O, taxes

- New in 2025: Buyers may need to pay agents directly

- Pro tip: Commission is negotiable, especially in high-value deals

- Flat-fee alternative: $100/year + $100/closing with Realty Hub = keep 100%

In this guide, we break down what agents really earn, what factors impact your net income, and how to protect your margins in a changing market.

How Much Do Real Estate Agents Actually Get Paid?

In most traditional real estate transactions, the total commission averages between 5% and 6% of the home’s final sale price. That fee is typically split between the listing agent (who represents the seller) and the buyer’s agent. So, on a $400,000 sale, a 6% commission equals $24,000, about $12,000 per side.

But that’s just the surface.

Each side of the deal is usually split again with the agents’ respective brokerages. If an agent is on a 70/30 split with their broker, they’d keep $8,400 of that $12,000, before taxes, fees, and business expenses.

Here’s a quick breakdown:

- Total sale price: $400,000

- 6% total commission: $24,000

- Split between agents: $12,000 each

- Agent/broker split (70/30): $8,400 agent / $3,600 broker

- Final take-home (post-tax): closer to $5,500–$6,000

And that’s in the traditional model.

What Affects an Agent’s Take-Home Pay?

Commission Splits With Brokers

The biggest factor in what an agent actually takes home is their agreement with their brokerage. Traditional brokerages often use a 70/30 or 80/20 split, which means the broker takes a portion of the agent’s commission. While some top performers negotiate better terms, most new or mid-level agents are stuck giving away 20%–30% right off the top.

Then there’s the tax burden. Self-employed real estate professionals often pay both sides of Social Security and Medicare taxes, in addition to income tax.

Add in marketing expenses, transaction coordination, and office supplies, and it’s easy to see how that $12,000 gross can quickly shrink to $5,000 net.

Broker Fees, Dues & Deductibles

Beyond commission splits, agents at traditional firms may face:

- Desk fees (whether or not they use the office)

- Franchise fees for brand-name brokerages

- Technology subscriptions for tools they may not even use

- Association dues and MLS access

- E&O insurance premiums, often marked up by the brokerage

These costs can add up to thousands annually. At Realty Hub, agents avoid nearly all of these expenses. For just $100/year + $100/closing, they gain access to broker support, E&O insurance, and full independence, no quotas, no mandatory memberships, and no hidden deductions.

Who Actually Pays the Commission, and How?

The standard commission structure can be confusing, especially for first-time buyers and sellers. Technically, the seller pays the commission, which is deducted from their proceeds at closing.

But that doesn’t mean the buyer is off the hook.

In practice, the commission is baked into the sale price. That means the buyer still pays indirectly, because they’re financing a slightly higher home price that includes the seller’s cost to cover agent fees.

So who pays both agents? Yes, it comes from the seller’s side, but it’s funded by the buyer’s money. In effect, both parties contribute to the commission.

This setup has led to confusion, especially now that new rules are changing how commissions are disclosed. Some buyers worry they’ll be hit with surprise agent fees, especially if MLS systems no longer show the buyer agent’s compensation.

Are you responsible for both agents?

Answer: Indirectly, yes. Even though the seller pays the commission, the buyer funds the sale. And as commission disclosure rules evolve, buyers may increasingly negotiate and pay agents directly. That’s why understanding your agreement before touring homes is more important than ever.

How Commission Structures Are Changing in 2025

NAR Lawsuit & MLS Transparency

The commission model is undergoing a fundamental transformation in 2025. Following the landmark NAR lawsuit settlement, a significant shift is taking place: buyer agent compensation will no longer be displayed on the MLS. This change alters how compensation is presented and negotiated, and pushes buyer agents to reframe how they demonstrate their value.

As part of the new compliance framework, buyer’s agents are now required to have signed agreements in place with their clients before providing services. This adds clarity, but also pressure. Agents must outline their fee structure upfront and secure commitment early in the process.

The result? A rise in alternative commission structures:

- Flat-fee arrangements (a set dollar amount regardless of price)

- Hourly consulting rates

- Hybrid agreements combining percentage and service-based pricing

These models reward transparency and create space for agents to tailor their compensation to the actual value they deliver. But they also introduce a new level of scrutiny from buyers, and potential confusion.

Buyer Agent Compensation May Shift to Buyers

One of the biggest changes: buyers may now need to pay their agent directly, out-of-pocket at closing. This was previously rare, as buyer commissions were typically covered by the seller’s proceeds. With MLS fields no longer showing buyer agent compensation, buyers must now actively negotiate agent payment as part of their home search strategy.

For many, this raises financial concerns. First-time buyers in particular worry about how to cover agent fees when they’re already stretching for a down payment and closing costs.

Unless compensation is negotiated into the purchase contract, buyers may need to pay their agent at closing with personal funds. However, savvy agents are already working with clients and lenders to find creative solutions, including negotiating seller concessions or building fees into offer terms.

This shift also forces agents to justify their commission upfront, not after the fact. That means explaining their role in negotiation, contract structuring, compliance, and closing logistics from day one.

How to Negotiate Commission as a Buyer or Seller

Whether you’re selling your home or buying one, commission isn’t fixed, it’s negotiable. But few clients know when or how to bring it up.

Here’s a step-by-step approach:

- Review the listing agreement or buyer’s agent agreement carefully before signing.

- Ask for clarity on how the commission is structured and what services it covers.

- Negotiate based on property value. High-value homes often carry higher commissions, this can be a leverage point for reduction.

- Offer something in return. Agents may agree to lower fees in exchange for:

- Repeat business

- Dual representation (selling and buying)

- A quick, clean deal

- Set expectations in writing. Always get commission agreements in writing, especially now that buyer-side terms are under scrutiny.

And what about FSBO (For Sale By Owner) properties? These often don’t offer buyer agent commissions at all. In those cases, buyers must negotiate separately with their agent, which may trigger an out-of-pocket fee.

What Services Justify Commission Fees?

When clients see a 2.5%–3% commission on a six-figure sale, it can seem like easy money, but the reality is far more complex.

Here’s what professional agents actually do to earn their fee:

- Market pricing strategy (CMA): Agents analyze recent sales, market conditions, and neighborhood trends to set pricing that attracts offers without leaving money on the table.

- Negotiation and contract expertise: From offer to inspection to closing, agents navigate high-stakes conversations that can win or lose thousands for their clients.

- Marketing execution: Listing agents coordinate professional photos, staging, MLS uploads, flyers, and open house events, often out of pocket.

- Compliance and documentation: Every deal involves contracts, disclosures, timelines, escrow, appraisals, and inspections. Agents ensure it’s all coordinated correctly and on time.

- Problem-solving and deal-saving: When lenders stall, appraisals come in low, or inspections reveal major issues, it’s the agent who jumps in to salvage the transaction.

Many agents work 20–40+ hours on a single transaction. Their fee isn’t just for showing homes, it’s for guiding complex, high-risk deals from start to finish.

Tips to Maximize Your Real Estate Income in 2025

Even with changes to commission norms, real estate remains one of the most powerful income-generating professions, if you structure your business correctly.

Here’s how to protect your margins and keep more of what you earn:

- Track every expense: Marketing, mileage, dues, and software all add up. Keeping clean records not only boosts profitability, it also improves your tax deductions.

- Know when to negotiate your split: High-producing agents have leverage. Use it. And if you’re not getting a better split, it may be time to change your model.

- Use a flat-fee brokerage if you’re self-sufficient: If you don’t need hand-holding, don’t overpay.

- Avoid hidden broker costs: Franchise fees, desk fees, and tech subscriptions can quietly eat away at your net income. Evaluate what you truly need, and ditch the rest.

- Don’t assume all agents earn the same: Geography, price point, brokerage model, and negotiation all influence what you actually take home. The smartest agents know how to structure their careers intentionally.

Commission Models Beyond the Split: What’s the Best Option for Agents?

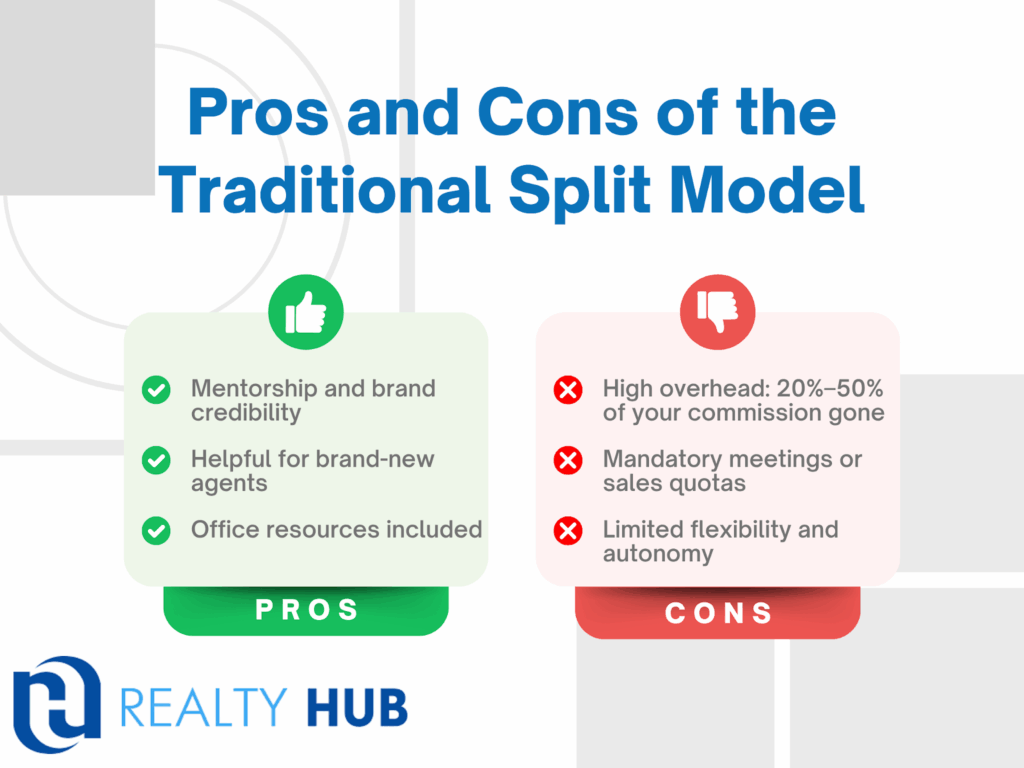

Traditional Split Model

The traditional brokerage model is built around commission splits, where agents share a percentage of each transaction with their broker. This model typically includes access to:

- Office space

- Mentorship or training

- Leads (in some cases)

Pros:

- Mentorship and brand credibility

- Helpful for brand-new agents

- Office resources included

Cons:

- High overhead: 20%–50% of your commission gone

- Mandatory meetings or sales quotas

- Limited flexibility and autonomy

For agents who value structure and in-person support, this model still works. But it can quickly feel restrictive as your production grows.

Flat-Fee Brokerages

Flat-fee brokerages are transforming how modern agents operate. Instead of giving up a percentage of every deal, agents pay a fixed fee per transaction, and keep everything else.

Realty Hub’s model:

- $100/year + $100/transaction

- 100% of commission goes to the agent

- E&O insurance included

- No desk, franchise, or tech fees

- No MLS or REALTOR® association requirement

This structure supports agents who are:

- Full-time and ready to scale

- Part-time or referral-only

- Budget-conscious or managing real estate as a second income

Flat-fee brokerages like Realty Hub offer total autonomy without sacrificing compliance or support. You run your business your way, with real savings and zero micromanagement.

Choose a Model That Pays You, Not Your Broker

Realty Hub was built for agents who are tired of giving away their income for services they don’t use or need. Our flat-fee brokerage model is lean by design, letting agents keep more of their money without sacrificing support.

The real value in real estate lies in your relationships, your knowledge, and your ability to close deals, not the brokerage brand on your business card. Flat-fee models like Realty Hub are giving agents the structure to operate freely, stay compliant, and keep what they earn.

You built the relationship. You closed the deal. You deserve the commission.

👉 Join Realty Hub today and take full control of your income.