Most real estate brokers charge 5–6% of the home’s sale price, typically split between buyer and seller agents. Brokerages may take 20–50% of an agent’s cut. Flat-fee and 100% commission models now let agents keep more. Learn what’s fair, what’s negotiable, and how to keep more in 2025.

But here’s what many agents don’t realize: a huge portion of that money never reaches them. Traditional brokerages often take 20% to 50% of your share through commission splits, desk fees, franchise costs, and “technology” charges. And if you’re a seller, you’re still expected to cover the buyer’s agent commission, though that’s finally changing in 2025.

At Realty Hub, we’ve built a smarter alternative. Our agents keep 100% of their commission and pay just $100 per year and $100 per transaction. That’s it. No splits. No hidden fees. No mandatory memberships. Just clean, simple math, and more money in your pocket.

If you want a breakdown of how commissions really work, where the money goes, and how to avoid overpaying in 2025, keep reading. We’ll walk you through it all.

What Percentage Do Most Brokers and Agents Charge?

The industry standard for real estate commissions in 2025 still hovers between 5% and 6% of the home’s sale price. That total is usually split between the listing (seller’s) agent and the buyer’s agent, meaning each walks away with 2.5% to 3%, assuming no additional splits with their broker.

Traditionally, the seller pays both agents’ commissions from the proceeds at closing. But that model, once untouchable, is starting to shift thanks to recent legal reforms.

Recent Changes: Commissions Post-2024 Lawsuit

A major legal settlement in 2024 reshaped the way agent commissions are handled. One of the most impactful changes? Buyers can now be responsible for paying their own agent, rather than relying on the seller to cover both sides.

This shift matters for two reasons:

- Sellers now have real negotiation power over commission payouts.

- Buyers must now assess the value of their agent’s work, and whether they’re willing to pay for it out of pocket.

If you’re selling, this means you’ll want your listing agreement to clearly define who’s paying whom, what’s negotiable, and whether buyer agent compensation is included. And if you’re buying, you’ll need to talk with your agent upfront about compensation expectations.

What Percentage Do Brokers Take from Agents?

While the public hears “3% commission,” agents know that’s rarely the full story. Most traditional brokerages operate on a split model, where the agent hands over a cut of their earnings, often 50/50, 70/30, or 80/20, until a certain cap is hit.

Then come the extras:

- Franchise fees (3–8% off the top)

- Desk or office fees (monthly or annual)

- Tech subscriptions you didn’t ask for

- Marketing or training fees baked into your split

For many agents, that means half their income disappears before they see a check.

Is 1% a Good Broker Fee?

You’ve probably seen ads for “1% commission” agents, especially in competitive or high-priced markets. And yes, some agents and brokerages offer these ultra-low rates, but with trade-offs.

When 1% Works:

- You’re selling in a hot market with minimal effort required

- You don’t need help with marketing, staging, or negotiation

- You’re okay with less personal attention

What You Might Sacrifice:

- Reduced exposure if the agent doesn’t list on the MLS

- Limited availability due to volume-based business

- No help prepping the property for maximum value

Before choosing a 1% agent, ask what’s actually included:

- Will they list on the MLS?

- Are open houses, pro photos, or staging support included?

- Who handles paperwork, disclosures, and showings?

A lower commission only works in your favor if you’re still getting real value. Otherwise, that 1% fee could cost you thousands in missed offers or a weaker sale price.

Commission Negotiation: How Much Is Really Flexible?

Yes, commission is negotiable, and it always has been. The industry’s “standard” 5–6% isn’t written in stone, especially in 2025’s evolving landscape.

What Factors Shape Commission Rates?

- Property price: Agents may reduce their rate on higher-priced homes

- Market conditions: In a seller’s market, where listings move fast, agents might accept less

- Repeat clients or referrals: Many agents offer loyalty pricing

Tiered Strategies Work Both Ways

Some agents use a performance-based model, like:

- 5% if the home sells under asking

- 6% if it sells above list

- Bonus % if they secure a bidding war

It gives the agent skin in the game, and aligns with your goals.

Dual Agency Discounts

If one agent represents both buyer and seller, they often offer a discount on total commission. But proceed with caution. Dual agency limits what the agent can disclose, and sometimes neither side gets full advocacy.

“Am I Overpaying?”, Ask These:

- What exactly are you doing to earn this commission?

- Will I see itemized marketing deliverables?

- How many listings are you managing right now?

When you’re clear on value, it’s easier to negotiate with confidence.

What Are Agents Really Earning After the Split?

That 3% commission sounds good, until it’s sliced up.

Let’s break it down:

- Brokerage split: Up to 50%

- Franchise fee: 3–8% of your gross

- Marketing, signage, CRM, E&O insurance

- Self-employment tax and income tax

What starts as $9,000 might end up closer to $3,500 net after everyone takes their cut.

At Realty Hub, we’ve built a model that flips that script. Instead of taking a percentage, we charge a flat $100 per transaction, so the rest is yours to keep.

That shift is why 100% commission brokerages are growing fast. Agents want freedom, simplicity, and income that matches their effort.

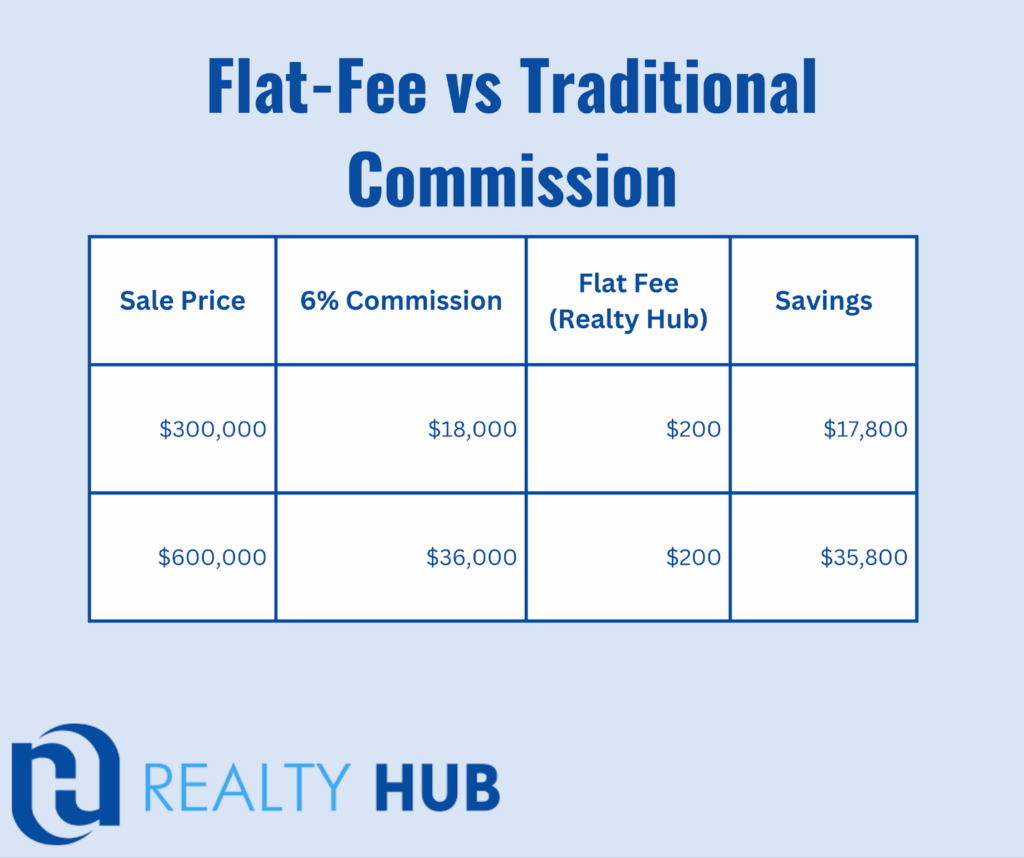

Flat-Fee vs Traditional Commission: Real Math

Let’s do the numbers:

And that’s not even accounting for the monthly desk fees, tech subscriptions, or marketing deductions many brokerages apply.

Tip: If you’re an agent, or even a seller, use this chart to see what you’re really leaving on the table.

Bonus:

With Realty Hub, there are:

- No splits

- No franchise fees

- No office costs

- Just more of your money, staying with you

How to Avoid Commission Confusion

Real estate commissions are famously opaque. But a little prep can save you thousands and a whole lot of stress.

Questions to Ask Every Agent You Interview:

- Who pays who? Are you paying one side, both sides, or neither?

- What’s your actual take-home? Transparency matters when choosing a partner.

- What happens if the sale falls through? Make sure fees are tied to success, not just signing paperwork.

Tip: Want to know how well your agent really performs? Search their active listings. Look at photos, descriptions, and pricing. If they’re cutting corners there, they’ll likely do it with your sale, too.

Agent Worries: Real Talk

If you’ve ever questioned the value of the commission you’re paying, or the agent you’re working with, you’re not alone.

“I feel like I’m overpaying.”

You might be. If your agent lists your property, uploads it to the MLS, and disappears, you’re not getting the value that 5–6% should deliver. Ask for a breakdown of their process, and don’t hesitate to negotiate or explore flat-fee options.

“Do I still owe if the deal crashes?”

In most cases, commission is only paid upon a successful closing. But always confirm that your listing agreement includes a protection clause, one that ensures you don’t owe commission if the buyer walks away.

“My agent just listed and ghosted.”

Unfortunately, some high-volume agents spread themselves thin. When working with any broker, especially discount ones, clarify how communication and showings will be handled before you sign anything.

The truth? Transparency protects you. Whether you’re a seller or an agent, always ask the right questions, and work with professionals who actually answer them.

Choosing the Right Brokerage Model for You

There’s no one-size-fits-all when it comes to brokerage models. But here’s how they stack up depending on how you work.

Traditional Split Models

Best for:

- New agents who need heavy coaching

- Team environments with lead flow

- Agents who benefit from in-person accountability

But they come with downsides: percentage cuts, fees, and quotas that reduce take-home pay.

Flat-Fee Models (Like Realty Hub)

Best for:

- Part-time agents who want freedom without extra costs

- Referral-only agents who don’t want to pay MLS or association dues

- Independent full-timers who want to keep what they earn and choose their own tools

And unlike most brokerages, Realty Hub doesn’t require:

- MLS membership

- REALTOR® association dues

- Desk time or mandatory meetings

You keep your autonomy, and your commission.

Ready to Stop Splitting Your Hard-Earned Commission?

You came here asking: What percentage do real estate brokers really charge? But the better question is: How much do you actually keep?

If you’re tired of giving up 30% (or more) of your income to cover desk fees, franchise splits, and “tech packages” you don’t use, there’s a better way.

With Realty Hub, you get:

- 100% commission , Keep what you earn with just a $100/year and $100/transaction model

- Zero hidden fees , No desk fees, franchise taxes, or surprise charges

- No forced memberships , Skip MLS or NAR dues if they don’t serve your model

This is your career. You should keep what you build. Join Realty Hub or schedule a call to explore how we work and see how much more you could be earning, starting today.