Yes, commissions are taxable in Florida. Real estate agents must pay federal income and self-employment tax, even though Florida has no state income tax. Learn what’s taxable, how to avoid sales tax traps, and strategies to reduce your tax bill legally.

While the state doesn’t charge income tax, agents still owe federal income and self-employment taxes on every dollar they earn. Ignore this, and you risk underpaying the IRS, and overpaying your broker.

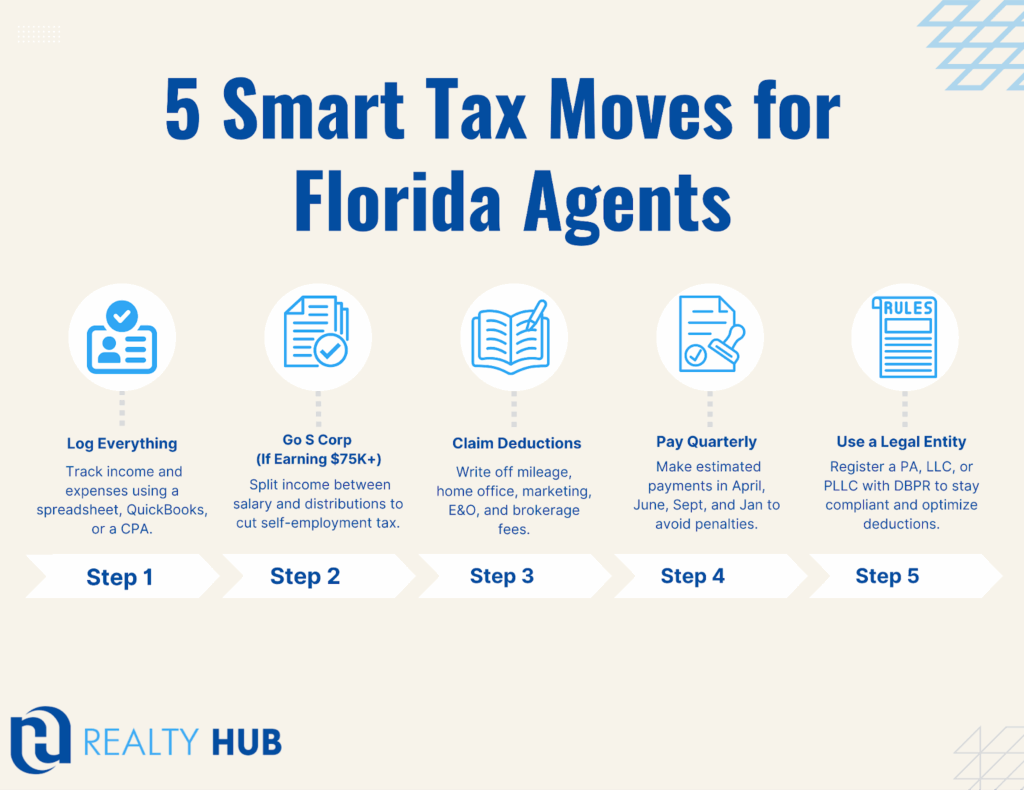

Here’s the good news: there are legal ways to reduce that tax burden, and the structure of your brokerage plays a big role.

From forming an S-Corp to maximizing deductions, smart agents can keep more of their income with the right tools and setup. That’s exactly where Realty Hub comes in.

At Realty Hub, agents keep 100% of their commission and pay just $100 per transaction. No splits, no surprise fees, just a lean model that gives you full autonomy and real tax-saving potential.

Whether you’re full-time, part-time, or referral-only, we give you the infrastructure to stay compliant and pocket more of what you earn.

If you’re ready to find out why commissions are taxed, what’s actually taxable, and how to pay less legally, read on.

Quick Answer: Yes, But Not How You Think

Florida doesn’t charge income tax, but that doesn’t mean agents get a tax-free ride. Here’s the reality:

- Florida has no state income tax, so you won’t owe anything to the state.

- You still owe federal taxes, and if you’re a 1099 contractor, the IRS expects you to handle that yourself.

- Real estate commissions are considered self-employment income, not employee wages.

That means agents are responsible for federal income tax and self-employment tax (15.3%). If you’re not planning for this, you’re likely underpaying, and setting yourself up for penalties later.

What Real Estate Agents Must Pay (2025)

1. Self-Employment Tax (15.3%)

Every commission check is subject to this:

- Covers Social Security (12.4%) and Medicare (2.9%)

- Applies if you earn more than $400 annually

- High earners pay an extra 0.9% Medicare tax over $200k (single) or $250k (married)

2. Federal Income Tax

The IRS taxes commissions just like any other income:

- Ranges from 10% to 37%, depending on your total earnings

- Pro tip: Budget 25–30% of your gross income to cover taxes throughout the year

3. No Florida State Income Tax

You won’t owe income tax to the state of Florida, but that doesn’t mean you’re off the hook:

- You may still owe use tax or sales tax on specific transactions (explained below)

- Federal compliance still applies, regardless of your state

Is Sales Tax Applied to Real Estate Commissions?

This is where many agents get tripped up. Here’s the breakdown:

- No, your commission is not subject to Florida sales tax

- Yes, sales tax can apply if you sell or include tangible goods

When Sales Tax Does Apply

If you do any of the following, you may owe Florida sales tax:

- Itemize personal property (e.g., furniture, appliances) separately in a sales contract

- Sell tangible goods as part of your service offering (e.g., staging equipment)

- Provide taxable services (like short-term rental setup or furniture rentals)

If personal property is bundled into the total home price and not itemized, sales tax typically doesn’t apply.

Are Membership Fees Taxable in Florida?

Membership fees can be tricky, but here’s how they break down for agents:

- MLS and REALTOR® dues are typically not subject to sales tax

- These fees are usually deductible as business expenses

- Brokerage fees, like Realty Hub’s $100/year charge, are fully deductible, but not taxable as income

- If membership includes access to tangible goods or physical services, there may be tax implications, but that’s rare for real estate agents

Key takeaway: If it’s part of your business operation and not tied to a tangible product, it’s likely deductible, not taxable.

4 Worries Agents Have About Commission Taxes

We’ve worked with agents across Florida, Georgia, and Alabama, and these are the most common pain points they face:

- Worry #1: “Am I even supposed to be paying taxes?” Many misunderstand the absence of state income tax to mean they owe nothing. Federal tax still applies.

- Worry #2: “Did I accidentally trigger sales tax?” Listing furniture separately in a contract can result in unexpected tax bills. Bundle items to avoid this.

- Worry #3: “Can I get in trouble for collecting my check wrong?” Yes. Commission must go through your broker or approved entity (like a PA or LLC). Realty Hub agents are fully covered here.

- Worry #4: “What if I forget to pay quarterly taxes?” Late or missed payments can lead to IRS penalties. Plan ahead and pay quarterly.

Realty Hub Agent Tip: Keep More, Stress Less

Here’s how we help agents stop worrying about taxes and start focusing on building wealth:

- Flat-fee model: $100/year + $100 per transaction. That’s it.

- Keep 100% of your commission, no splits, no franchise fees.

- Built-in compliance for collecting commission through the proper channels (PA, LLC, PLLC)

- Optional referral-only status lets you avoid MLS and association fees, while still earning and deducting

This model works especially well for:

- ✔ Self-starters who want to maximize their income and minimize their overhead

- ✔ Agents working part-time, full-time, or even semi-retired

✘ Not for agents who need heavy hand-holding or want lead programs baked in

Get Ahead, Not Audited

If you’re a Florida agent, don’t let the lack of state income tax fool you, your real estate commissions are fully taxable. That includes:

- Federal income tax based on your bracket

- Self-employment tax (15.3%) on your entire net earnings

- Potential sales or use tax if you itemize goods or fail to pay at purchase

The agents who succeed long term are the ones who get ahead of this, not those who react after a surprise IRS letter.

The key is building a business structure that works in your favor, not against you.

Bonus: What the IRS Doesn’t Tell You

Most agents are so focused on closings they forget their biggest cost, taxes. Here’s what doesn’t show up in your 1099:

- You can’t deduct everything unless you keep receipts and records

- The IRS doesn’t tell you that forming an S-Corp can save thousands

- You might be collecting commission illegally if you’re not routing it through your broker or PA/LLC

Realty Hub’s systems are built to protect agents from these blind spots. We simplify compliance so you can focus on selling.

Think taxes don’t affect how much you take home?

Most agents lose tens of thousands a year, not to bad deals, but to poor tax structure and bloated brokerage fees. That’s why Realty Hub exists.

- Flat-fee brokerage: $100 per year, $100 per transaction. That’s it.

- Keep 100% of your commission, no matter how much you earn

- Run your business under your PA or LLC, fully compliant with FREC

You keep more of every check. You stay compliant without micromanagement.You finally run your real estate business like a business.

If you’re ready to stop splitting your hard-earned commission and start running a lean, profitable business, join Realty Hub today.

FAQ Agents Ask

Do Realtors pay taxes on commission in Florida?

Yes. Commissions are fully taxable at the federal level through income and self-employment tax. Florida just doesn’t take a state income cut.

Who is exempt from sales tax in Florida?

- Agents don’t pay sales tax on commissions

- Nonprofits or certain government entities may be exempt when buying/selling property

- Sales tax applies only to tangible goods or itemized property

What is taxable in Florida for agents?

- Itemized personal property in contracts (e.g., furniture or fixtures)

- Business purchases where sales tax wasn’t collected (triggers “use tax”)

- Services like staging or furniture rental if billed separately

Are my fees to the brokerage taxable?

- No, but they are fully deductible

- At Realty Hub, we keep it simple: $100/year + $100/closing

- You can write off every penny as a business expense