Yes, real estate agents can deduct commissions as business expenses if they’re self-employed. Report them on Schedule C, Line 10. Commissions paid to others, broker fees, license costs, and referral splits are also deductible, if they’re tied to income-producing activity.

If you’re a self-employed real estate agent, you can deduct commissions as legitimate business expenses.

That includes referral payouts, broker fees, transaction costs, and more, as long as they’re tied to income-generating activity and properly documented on your tax return.

At Realty Hub, our flat-fee model ($100 per year, $100 per transaction) makes commission deductions straightforward. There are no confusing splits, hidden franchise charges, or “desk fees” that complicate your books.

Our agents know exactly what they’re paying, and that makes tax prep cleaner, and 100% deductible.

If you’re wondering how deductions work for part-time, referral-only, or non-MLS agents, and you want to avoid audit flags and missed opportunities, read on. We’ll break it down step-by-step.

Who Can Deduct Real Estate Commissions?

If you’re a licensed real estate agent working independently, yes, you likely qualify to deduct commissions and fees tied to your business. Here’s who qualifies:

- Independent contractors and 1099 agents: If you receive 1099 income and operate as a self-employed agent, commission-related expenses are fair game.

- Referral-only or part-time agents: Even if you’re not closing multiple deals per year, you can deduct business expenses as long as your license is active and you’re operating with business intent.

- Agents with parked licenses at virtual brokerages: Agents with no desk time and no franchise obligation, like those at Realty Hub, can still claim business-related deductions if they’re maintaining their license and making referral income.

Realty Hub Tip: Don’t let low volume or part-time status stop you from claiming what you’ve earned. The IRS doesn’t require you to be full-time, just active and business-focused.

What Real Estate Commissions Are Tax Deductible?

When commissions are tied to income-generating work, they’re generally deductible. That includes:

Common Deductible Commission Expenses

- Referral fees paid to other agents

- Brokerage transaction fees (e.g., Realty Hub’s $100 flat rate)

- Split commissions shared with partners or teams

Other Deductible Business Costs

- Annual license renewal fees

- E&O insurance premiums (if you pay the deductible)

- Business cards, signs, and logo design

- Lead generation costs like Facebook ads or email campaigns

- Real estate software subscriptions (e.g., CRMs, e-signature tools)

- Mileage and home office usage (if working from home)

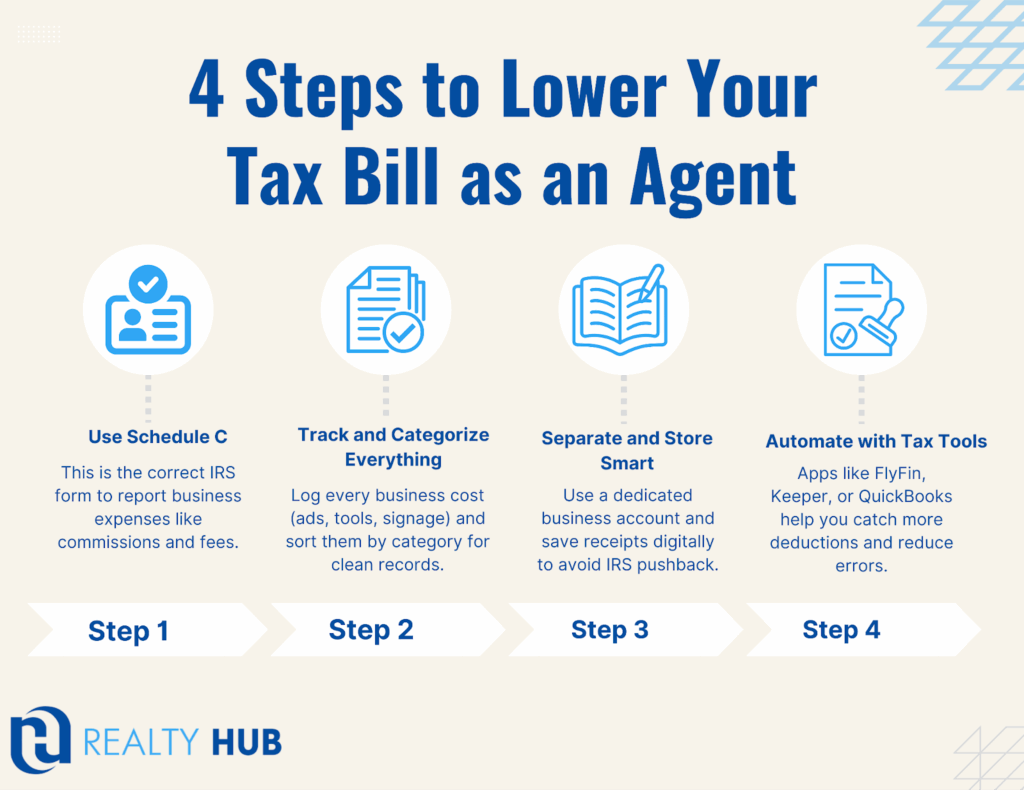

Realty Hub Tip: Report commissions and fees on Line 10 of Schedule C. Keep receipts, categorize every dollar, and use a business-only account to track everything cleanly.

The IRS Rules (and What Most Agents Get Wrong)

Before you write anything off, here’s what the IRS expects:

- Your expense must be “ordinary and necessary” for your business

- The cost must be directly tied to producing income

- Personal expenses are not deductible, including your own home purchase or family legal disputes

- Documentation matters, keep a digital trail and avoid cash-only records.

The Most Frequent Mistakes Agents Make

Don’t let small missteps trigger bigger problems. Here’s what to avoid:

Audit Triggers and Red Flags

- Using a single account for both personal and business purchases

- Deducting fees tied to your personal real estate investments

- Writing off club memberships, gym fees, or entertainment as “business”

What the IRS Does Allow

- Paid leads from Zillow, Facebook, or other platforms

- Software subscriptions used exclusively for deals

- Optional association dues (deductible if you choose to join)

Keep It Simple With Realty Hub

Realty Hub agents keep things simple, and that pays off come tax season:

- A referral agent writes off $100 membership + $100 referral transaction fee = clean, simple deduction

- A part-time investor-agent deducts license renewal, home office, and software subscriptions used for client management

- A full-time agent deducts marketing expenses, E&O deductible, tech tools, and mileage from showings

Our flat-fee structure eliminates the guesswork. Agents don’t have to untangle splits, back-end fees, or “admin” charges that traditional brokerages bury in the fine print.

Florida’s Fastest Growing Real Estate Markets

If you’re focused on increasing income (and write-off potential), Florida’s growth markets offer real opportunities. These aren’t just hot cities, they’re places where agents can close more deals, generate more commissions, and deduct more business expenses.

Top Tax-Efficient Growth Markets

- Cape Coral, Strong inventory and affordable pricing = fast-moving deals for both buyers and investors.

- Naples, High-end clients and luxury listings mean bigger commission checks, and larger deductible expenses.

- Orlando, Constant demand from tourists, relocators, and investors keeps the pipeline full.

- Pensacola, An overlooked gem for coastal growth, ideal for investor agents and value buyers.

- Miami, Fast cycles, international buyers, and high values create frequent, high-dollar closings.

Realty Hub Tip: The more active and diverse your markets, the stronger your case for claiming marketing, travel, and lead gen expenses.

Keep More, Deduct Smarter: Why Agents Choose Realty Hub

If you’re asking, “Can I write off commissions on my taxes?”, what you’re really asking is: “Is there a simpler way to run my business without giving so much away?”

Realty Hub makes the answer easy:

- Flat fees that are 100% deductible

- No messy commission splits

- No desk fees, franchise charges, or surprise admin costs

Our model is built for agents who want control, whether you’re full-time, part-time, or focused on referrals. If you need training wheels, leads, or mandatory meetings, we’re probably not for you.

Join Realty Hub and keep more of what you earn. Here’s how it works.

FAQs About Commission Write-Offs

Can I write off commissions I pay to another agent?

Yes, if tied to a closed transaction and reported properly.

Can I deduct my brokerage’s flat fee?

Absolutely. Realty Hub’s $100/year and $100/transaction fees are direct business costs.

What about referral commissions I receive?

Report them as income. Any cost you incur to earn them is deductible.

Is my license renewal deductible?

Yes, it’s considered a regulatory business expense.

I work part-time or just do referrals, can I still deduct?

Yes, as long as your license is active and your expenses are business-related.