Yes, real estate commissions in Georgia are taxable. Agents must report them as self-employment income and pay federal, state, and 15.3% self-employment tax. The 2024 tax law changes also affect how commissions are reported and what agents may owe.

If you’re a licensed agent, those commission checks count as self-employment income, and that means you’re on the hook for federal, state, and self-employment taxes.

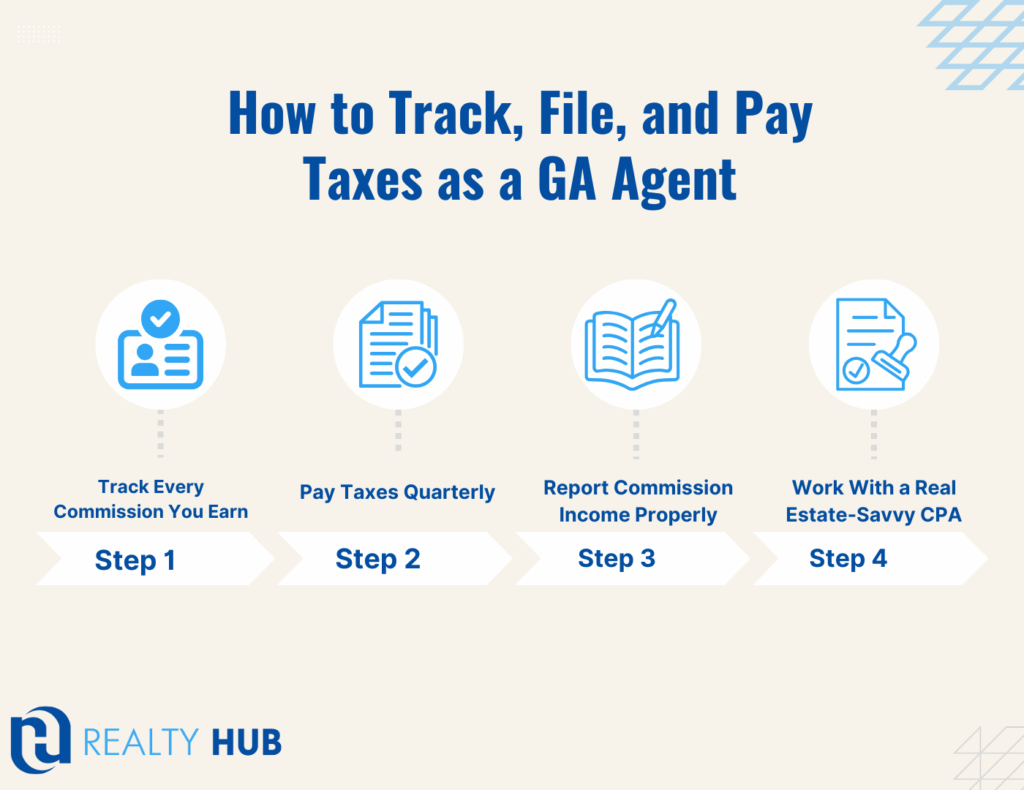

But knowing they’re taxable is only step one. How you handle that income, what you set aside, what you deduct, and how you file, can make the difference between smooth sailing and surprise penalties.

At Realty Hub, we work with Georgia agents every day who want more control over their income and fewer financial headaches. Our flat-fee brokerage model means you keep 100% of your commission and take charge of how your business income is managed, no splits, no franchise fees, and no surprises.

Not everyone’s ready for that kind of independence, but if you are, keep reading.

We’ll walk you through exactly how real estate commissions are taxed in Georgia, and how to protect your bottom line.

Here’s What That Means for Agents

In Georgia, commissions aren’t just income, they’re self-employment income. That puts agents in a different tax category than W-2 employees.

You’re responsible for handling:

- Federal income tax (based on your tax bracket)

- Georgia state income tax (ranges from 1% to 5.75%)

- Self-employment tax (15.3% to cover Social Security + Medicare)

How you file depends on how your business is structured:

- Sole proprietors file using Schedule C

- S Corps file Form 1120-S and take a salary plus distributions

- All agents must track income and pay taxes quarterly

Agent Question: Do I have to pay taxes if I only earn commissions?

Realty Hub Answer: Yes. The IRS treats commission like freelance income, it’s fully taxable.

What’s Not Taxed in Georgia: Sales vs. Services

Real estate agents in Georgia often ask whether they’re also subject to sales tax or other hidden fees. The good news? In most cases, no.

Here’s what is not taxed:

- Sales tax does not apply to real estate services, you’re not selling tangible goods

- Use tax may apply if you bring untaxed goods into Georgia for business use (e.g., signs, equipment)

- Property taxes are paid by property owners, not agents

- Referral-only agents still owe income tax on referral earnings, even if they skip MLS membership

Tip: Don’t confuse sales tax with self-employment tax, they serve completely different purposes.

2024 Rule Changes: Who Pays the Buyer’s Agent?

A recent industry lawsuit shook up the traditional commission model in Georgia. Now, sellers are no longer obligated to pay the buyer’s agent commission.

Here’s what that means for you:

- Buyers may now pay their agent directly

- That changes how you get paid, and how you document that income

- You must now:

- Track who pays you

- Verify how/when commission is disbursed

- Adjust your tax prep to reflect the new structure

Agent Worry: Will I owe more tax if the buyer pays me instead of the seller?

Realty Hub Answer: No. Your total income is still taxable either way, you just need to track it accurately.

Maximize Deductions to Lower Your Tax Bill

Every dollar you deduct reduces your taxable income, and your tax bill. If you’re earning more because you’re keeping 100% of your commission, it’s even more important to track deductions accurately.

Here are common write-offs for Georgia agents:

- MLS fees (only if you opt in, many Realty Hub agents don’t)

- Errors & Omissions (E&O) insurance

- Home office expenses (square footage, utilities, internet)

- Real estate software (CRMs, e-signature tools, file storage)

- Marketing and signage (including social ads, postcards, and photography)

- Vehicle mileage at $0.67/mile (2024 IRS rate)

- Cell phone use (business % only)

- Virtual assistants or transaction coordinators

Realty Hub Tip: Keep clean records, if you’re ever audited, digital receipts are your best defense.

Agent Worry: What if I deduct something incorrectly and trigger an audit?

Realty Hub Answer: A tax-savvy CPA and good recordkeeping go a long way. When in doubt, track it and ask.

Unique Insights for Realty Hub Agents

At Realty Hub, our flat-fee model gives agents more income, but also more responsibility when it comes to taxes. That’s not a downside. It’s freedom.

Here’s how our structure helps:

- You keep 100% of your commission: you report full earnings but gain full deduction flexibility

- No splits, no desk fees, no franchise fees: simplifying your income and tax planning

- You control how and when you get paid: especially if you use attorney disbursement

- You can be referral-only: and still owe tax, even if you skip the MLS

- You’re not forced to join associations: which eliminates both dues and deductions

- You choose your tax structure: sole proprietor or S Corp, whatever fits your goals

- Our digital tools are deductible: from file storage to signatures

- You can outsource: transaction coordinators, VAs, etc., all deductible

- You don’t deal with green sheets or delayed payouts: which means simpler reporting

Smart Tax Tips for GA Agents in 2025

If you’re serious about growing your real estate income, tax efficiency is key. Small systems now = big savings later.

Here’s what we recommend:

- Open a separate business bank account

- Use a mileage tracking app (like MileIQ or Everlance)

- Consider forming an S Corporation if you earn $60K+ in commissions

- Use bookkeeping software (like QuickBooks or Xero)

- Hire a CPA who understands real estate taxes

- Schedule tax prep time monthly: don’t wait until April

These tips reduce stress, prevent penalties, and put you in control.

The Best Brokerage Model for Tax Simplicity

When you work with a traditional brokerage, you’re not just splitting commission, you’re adding tax complexity:

- Your income varies

- Your deductions are murky

- Your tax planning feels like guesswork

At Realty Hub, we built a model that simplifies all of that:

- Flat-fee: $100 per transaction, $100/year

- Keep 100% of your commission

- Use your own tools, build your own deductions

- Control how and when you get paid

We’re the right fit for agents who:

- Want to run lean, efficient businesses

- Prefer autonomy and low overhead

- Don’t need hand-holding or quota pressure

We’re not for agents who want constant lead generation or mandatory in-office support.

But if you’re ready to take full ownership of your income, and simplify the way you report, track, and keep it, Realty Hub was built for you.

Thinking of Switching to a Flat-Fee Model?

If reading this made you realize how much control you don’t have over your commission and taxes right now, you’re not alone. Most agents never get clarity on how their brokerage affects their financial life, until tax season hits and the numbers don’t add up.

At Realty Hub, we give that control back to you. Here’s how:

- Keep 100% of your commission: No splits. Just a flat $100 per deal.

- Total autonomy: You decide how to structure your business and deductions.

- Lean, virtual model: No bloated overhead. No surprise fees. Just smart systems that work.

If you’re ready to stop handing away a percentage of your income, and start building a real estate business on your terms, join Realty Hub.

Let us know when you’re ready to make the switch. We’ll make it simple.