Flat fee brokerages charge a set rate per year or deal, letting agents keep 100% commission. Percentage brokers take a cut (like 70/30). Learn the real difference, how each model affects your income, and which works best for new vs. experienced agents. Discover savings, hidden fees, and insider tips.

If you’re an agent wondering whether a flat fee or percentage-based broker commission will help you keep more of what you earn, here’s the simple answer:

Flat fee brokerages let you keep 100% of your commission by charging a small set fee per year or per transaction. Percentage-based brokers, on the other hand, take a cut, often 20%–50%, from every deal you close. For experienced agents, part-timers, or investors, that difference can add up to tens of thousands each year.

The choice really comes down to how you work:

- Flat fee means more money in your pocket on every deal, total control of your business, and predictable costs, but you need to be comfortable running lean, generating your own leads, and staying compliant without a franchise brand propping you up.

- Percentage-based splits may make sense if you’re just starting out and want hand-holding, brand recognition, or in-office mentoring, but beware of hidden fees, desk costs, and fine print that erode your take-home pay.

At Realty Hub, we’re a virtual, flat-fee brokerage that helps licensed agents in Florida, Georgia, and Alabama keep 100% of their commission for just $100 a year and $100 per transaction.

You’ll never pay franchise fees, forced tech subscriptions, or hidden upsells, and you’ll get compliance support when you need it, independence when you don’t.

If you’re ready to stop giving away a big chunk of your hard-earned commission, this might be the simplest switch you make in your career.

Want the full breakdown, step-by-step tips, and a few hidden traps to watch out for? Keep reading.

How Real Estate Commissions Work

Before you decide between a flat fee and percentage-based split, let’s get clear on how these models actually shape your paycheck.

- Traditional splits remain the norm for about 42% of agents, the familiar 70/30 or 80/20 split where your broker keeps a cut of every commission check. What many agents don’t realize is how quickly that adds up.

- Flat fee brokerages flip this upside down. Instead of giving up a percentage on every deal, you pay a predictable amount, like Realty Hub’s $100/year membership and $100 per transaction.

But remember: not all flat fee models are equal. Some still tack on desk fees, per-deal admin charges, or forced marketing costs. That’s why it’s worth asking the tough questions upfront: Where does my money really go?

Flat Fee vs. Percentage: Key Differences Explained

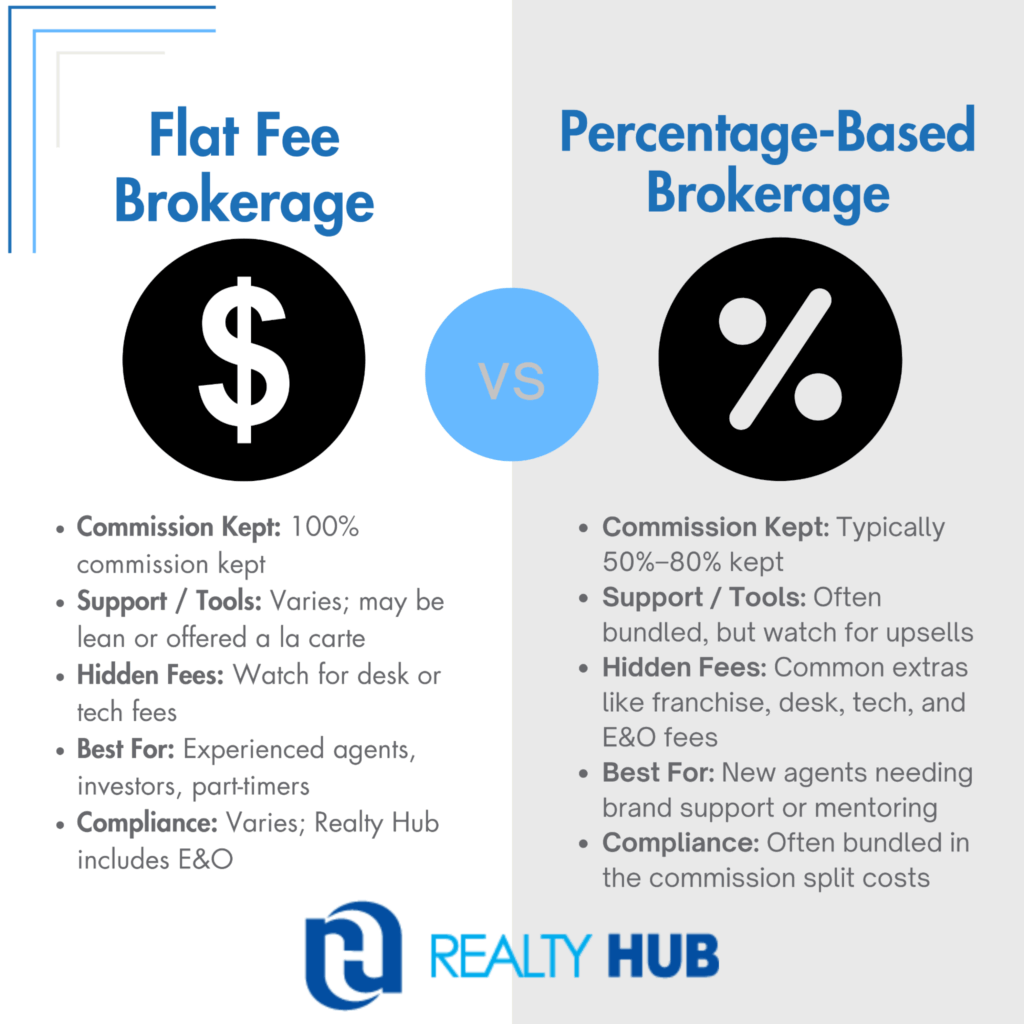

So what’s the real difference between a flat fee and a traditional split? Here’s a quick side-by-side snapshot:

Flat Fee Brokerage

- Commission Kept: 100% commission kept

- Support / Tools: Varies; may be lean or offered a la carte

- Hidden Fees: Watch for desk or tech fees

- Best For: Experienced agents, investors, part-timers

- Compliance: Varies; Realty Hub includes E&O

Percentage-Based Brokerage

- Commission Kept: Typically 50%–80% kept, the rest goes to the broker

- Support / Tools: Often bundled, but watch for upsells

- Hidden Fees: Common extras like franchise, desk, tech, and E&O fees

- Best For: New agents needing brand support or mentoring

- Compliance: Often bundled in the commission split costs

A flat fee brokerage isn’t the same as a “no service” model, Realty Hub proves you can have full compliance support without giving up a cut.

Plus, agents are free from forced tech tools or bloated franchise fees that do little for your bottom line.

When people ask, What’s the difference between a broker commission and a fee?, it comes down to control.

A flat fee is a known cost. A percentage is an open tap that drains income deal after deal. For agents who want to be their own boss, flat fee can mean more freedom and fewer surprises.

Who Should Consider Flat Fee Models?

If you want to maximize income without franchise handcuffs, here’s who flat fee models work best for:

- Experienced agents with steady deal flow: You keep every dollar above your low annual and per-deal fees.

- Part-time agents and investors: You can “park” your license, stay active, and capture tax benefits without unnecessary splits or association dues you don’t want.

- Agents tired of hidden costs: Flat fee models like ours bundle E&O insurance and compliance help, so you’re not nickel-and-dimed each time you close.

What if you don’t close enough deals to cover the flat fee? That’s a real worry. The good news is that our flat fee stays lean by design. You only pay $100 a year and $100 when you close. There’s no desk rent draining your account during a slow quarter.

We built Realty Hub for the agent who wants predictability, freedom, and no surprises. If that’s you, you’ll see exactly how much you keep after each commission clears.

Next up: who might stick with percentage splits, and why it sometimes makes sense.

Who Should Stick with Percentage-Based Splits?

A flat fee isn’t for everyone. If you’re just getting your feet wet in real estate, a traditional percentage-based brokerage may feel like a safer place to learn.

Here’s who a split model can work for:

- Brand-new agents who want in-office mentoring, built-in leads, and the comfort of a recognizable franchise sign.

- Agents who need the brand’s name to win clients in luxury or corporate markets, perception still matters in some corners of real estate.

- Those who value heavy oversight: If you want someone setting quotas, tracking progress, and pushing you every day, the structure of a big franchise might suit you.

But even here, you should run the math. High franchise fees and tiered splits mean the “support” can come at a steep price.

Ask yourself: Are franchise brokers worth the extra cost? If you’re paying 20–40% of every deal for brand perks you never use, or “training” you never actually get, it may be time to reconsider where that money goes.

Hidden Costs to Watch For (No Matter Which You Choose)

Whether you choose a flat fee or percentage-based split, surprises can eat away at your commission check faster than you’d think.

Here are a few cost traps we see agents get stung by every year:

- Errors & Omissions (E&O) insurance: Is it included? Many brokerages tack it on after the fact. Realty Hub builds it in, so you’re covered without an upcharge.

- Desk fees & franchise fees: Some split-based shops charge you monthly rent for a desk you don’t use, or a “brand fee” that shows up every month whether you close or not.

- Tech tools you never asked for: Some brokers require you to buy into CRM or marketing bundles. At Realty Hub, we don’t force agents into mandatory tech subscriptions.

- MLS dues & association memberships: Know when they’re truly required. Many agents don’t realize they can operate without paying for associations that don’t add value.

One of the biggest frustrations we hear from agents who switch to us? Hidden add-ons erode trust. We believe you deserve radical transparency: clear flat fees, no creeping charges, and no surprises buried in your payout.

Insider Tips for Choosing the Best Brokerage Model

Here’s how top producers make this decision with confidence:

- Run your numbers: List your average annual closings and compare what you’d pay in splits vs. a flat fee model, you might be surprised how much you’d keep.

- Check for hidden costs: Look closely at E&O insurance, desk fees, transaction add-ons, or MLS requirements.

- Consider parking your license: Part-time or investor agents often park a license with a flat-fee brokerage like Realty Hub to keep it active, save on dues, and capture referral income.

- Stay compliant, stay lean: Make sure your brokerage delivers real compliance help. At Realty Hub, that’s baked in.

- Remember our mantra: Support when you need it. Independence when you don’t. That’s the heart of a model that puts you first.

Keep reading for the real reason so many agents are ditching splits and reclaiming their commission, and a direct way to decide if you’re ready too.

Why More Agents Are Switching

The industry is changing because agents are asking a simple question: Why am I giving away so much of my commission for so little in return?

If you’re closing deals, generating your own leads, and paying for your own marketing anyway, that extra 20%–40% you hand over to your broker every transaction can feel like a tax on your hard work.

Flat fee models fix that. You pay a low, predictable cost, not a percentage that grows with every deal. You keep control over your branding, your pipeline, and your income. And when your market slows, you’re not stuck paying bloated desk fees or franchise cuts that drain your earnings.

That’s why more top producers, part-time agents, and investor-agents are turning to flat-fee brokerages. And with Realty Hub, you don’t have to choose between savings and support. You get E&O insurance, compliance help, and broker access, without paying franchise premiums or hidden upsells.

So ask yourself: Do you want to keep splitting your paycheck with your broker forever? Or are you ready to keep 100% of what you earn, close deals on your terms, and build your business with true freedom?

Ready to Keep More of What You Earn?

At Realty Hub, we built our model for agents just like you, agents who know their value and refuse to see their commission slip away with every transaction.

Here’s how our flat-fee brokerage helps you:

- Keep 100% of your commission, paying only $100 per year and $100 per transaction, nothing hidden.

- Get real compliance support when you need it, plus E&O insurance baked in.

- Skip the franchise chains: no desk fees, no mandatory MLS memberships, no forced tech packages.

If you’re tired of splitting your hard-earned commission, we’re ready to show you a smarter way. Stop paying for things you don’t need. Start building a business that works for you.

Learn how Realty Hub works, and see if you’re a fit today.