Yes, commissions are taxable in Alabama as self-employment income. This includes real estate commissions. Learn what income and services are taxed or exempt, how much you must earn to file, and practical tips to reduce your tax burden while staying compliant.

Yes, real estate commissions are fully taxable in Alabama. Whether you’re closing deals or collecting referrals, your commission income is subject to federal income tax, self-employment tax, and often state income tax obligations.

That’s the simple answer, but if you’re a licensed real estate agent, broker, or investor working in or across Alabama, it’s not the whole story.

Between nonresident withholding rules, quarterly tax estimates, changing commission norms, and confusing forms like WNR or NR-AF2, the actual tax process gets messy fast, especially if you’re flying solo.

At Realty Hub, we simplify that mess. Our virtual flat-fee brokerage model gives agents full commission control, direct deposit disbursements, and access to state-specific compliance support, without franchise fees, quotas, or mandatory association dues.

If all you needed was a yes-or-no, you’re good to go. But if you’re looking for clarity, control, and a smarter tax setup for your real estate income, keep reading.

Real Estate Commissions in Alabama

Commissions in Alabama are 100% taxable, no gray area here. Whether you’re an agent, broker, or referral-only license holder, the IRS and the state of Alabama treat commissions as income. That means you’re expected to file and pay accordingly.

- Classified as self-employment income

- Subject to federal income tax and 15.3% self-employment tax

- Alabama does not provide commission-specific exemptions

- Commission income must be reported, even if you only close one deal or earn from referrals

Bottom line: If you’re cashing a commission check in Alabama, you’re creating a tax liability, and you need a system to stay ahead of it.

What Income Isn’t Taxable in Alabama?

Not everything you earn or inherit is taxable in Alabama. The state exempts certain income categories, which is helpful when planning your overall tax exposure.

- Social Security benefits (if exempt at federal level, they’re exempt in Alabama too)

- Qualified retirement income from pensions or 401(k) withdrawals

- Gifts and inheritance (no state inheritance tax or gift tax)

- Capital gains on a primary residence

- Exclusion: Up to $250K for individuals and $500K for married couples if residency and ownership tests are met

These exclusions don’t apply to your commissions, but they do affect your overall taxable income, which impacts tax bracket and deductions.

When Do You Need to File Taxes in Alabama?

Whether you’re full-time, part-time, or referral-only, your commission income creates a tax filing obligation. Here’s when filing becomes mandatory:

- Single filers: Gross income over $5,250 requires a return

- Married filers: Gross income over $10,500 triggers filing

- Any income with taxes withheld: File to claim your refund

- Real estate agents: Must file regardless of income level if 1099 commissions are earned

As an agent, you’re considered self-employed. That means you may also owe quarterly estimated taxes, especially if your brokerage doesn’t withhold for you.

How Real Estate Commission Withholding Works in Alabama

For Resident Agents

If you’re a licensed real estate agent living in Alabama, you won’t face withholding at the time of sale, but you’re still responsible for reporting and paying your taxes.

- No state-mandated withholding at closing

- You must file a personal or business tax return that includes your commission income

- Quarterly estimated payments are required if you expect to owe more than $500 annually

- Realty Hub sends commissions via direct deposit after review, allowing agents to track earnings for tax filing

For Nonresident Sellers

Selling property in Alabama but living elsewhere? The state wants a cut upfront, through a mandatory withholding process.

- Buyers must withhold 3–4% of the sale price or actual gain

- Applies to:

- Out-of-state sellers

- Installment sales

- LLC or partnership-owned property

- You can use:

- Form NR-AF2 to base withholding on actual gain

- Form WNR or WNR-V for reporting and reconciliation

- Realty Hub agents should consult with closing attorneys to ensure the correct form is used, especially if the property is jointly owned

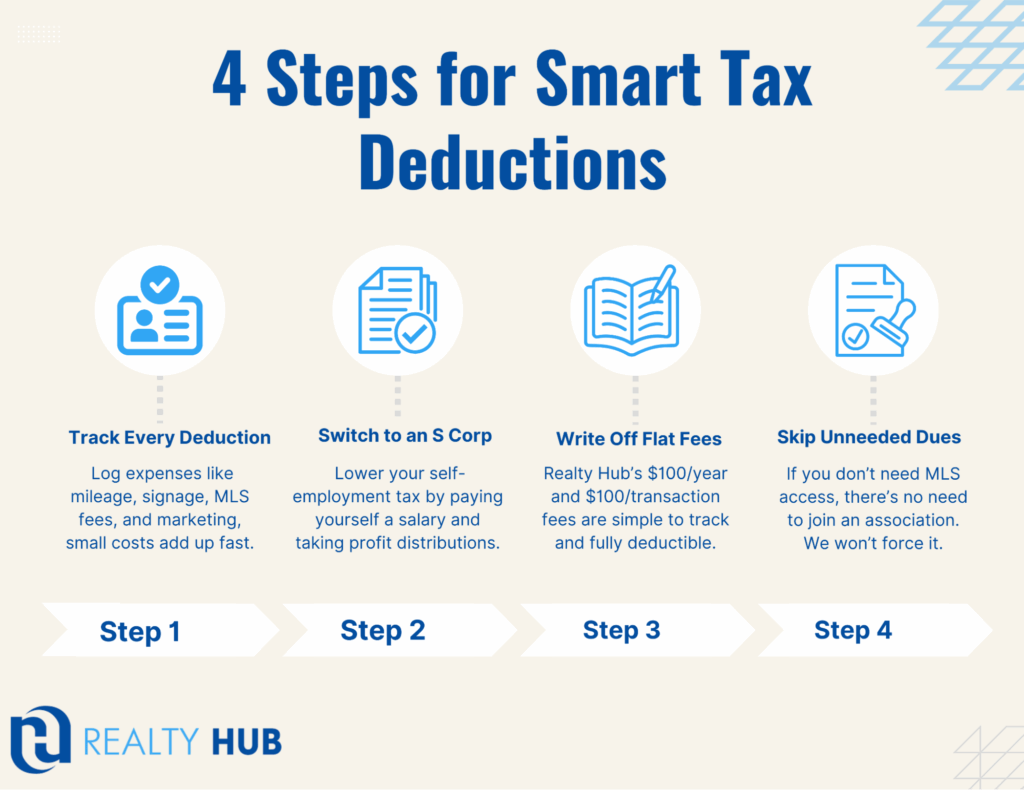

Realty Hub’s Advantage for Alabama Agents

When tax season hits, the last thing you want is a broker adding to your stress. That’s why Realty Hub was designed for agents who value simplicity and independence.

- Flat-fee model = predictable deductions

- $100 annually + $100 per transaction

- No franchise, tech, or desk fees

- Nothing hidden, nothing bloated

- Accurate 1099 disbursement

- We review commission files before releasing funds

- E&O insurance included

- One less business expense to track

- We don’t force association dues

- Referral-only agents and part-timers stay profitable

Whether you’re closing ten deals a month or sending a few referrals a year, our system supports how you work.

Know the Rules. Maximize the Profits.

You don’t need a law degree to handle your taxes, but if you’re an agent in Alabama, you do need clarity.

Real estate commissions are taxed. That’s a fact. But whether you’re overpaying, filing late, or getting hit with unnecessary penalties depends on how you manage your business and who your brokerage is.

At Realty Hub, we’ve built a model that works with your income goals, not against them.

- We give you direct deposit access to your commissions

- We eliminate the fog of franchise fees, hidden tech charges, and quotas

- We support agents in all phases, active, part-time, referral-only

When your systems are clean, your tax picture is clear, and your income goes further.

You’ve already earned your commission. Let’s make sure you keep more of it.

Want to Stop Overpaying? Here’s Your Next Move

If you’re a real estate agent in Alabama, you already know the pain points: surprise tax bills, withholding confusion, and commission checks that feel smaller than they should.

At Realty Hub, we designed our flat-fee brokerage to solve exactly that.

Here’s what you get with us:

- 100% of your commission, not a percentage game

- Tax-friendly flat fees ($100/year + $100/transaction)

- No franchise overhead, no quotas, no forced meetings

If you’re ready to stop splitting your commission and start maximizing your income, join Realty Hub today. You work hard for every deal, it’s time your brokerage worked just as hard for you.

FAQ: Taxes In Alabama

Do I have to file Alabama taxes if I only earn referrals?

Yes. Referral commissions are taxable income and must be reported, even if you don’t live in Alabama full-time.

Are E&O fees deductible?

Yes. Normally, you’d track and deduct this yourself, but with Realty Hub, E&O is included, so your cost structure stays lean and predictable.

Can commissions be paid at closing?

No. In Alabama, commissions must go through your brokerage first. Realty Hub reviews the file, then sends payment via direct deposit, typically within 1–2 business days.

Will I be taxed on the full sale price or just my profit?

If you don’t submit proper forms, the state may withhold based on the gross sale price. Use Form NR-AF2 to calculate withholding based on actual gain, this can prevent thousands in overpayment

Do I owe taxes if I sell at a loss?

No. If there’s no gain, there’s no state withholding tax due, but you may still need to file a return to report the loss.

Will the buyer withhold my commission if I’m out of state?

No. Buyers withhold on sales proceeds, not commissions. You’re responsible for filing and paying tax on commissions separately.

Do I need to submit any forms if I’m a resident?

No state withholding forms are required for residents, but you must file and pay your taxes normally.

Can I trust the affidavit process?

Yes, but accuracy matters. Buyers aren’t required to investigate false affidavits, but if proven false, liability can shift to the buyer, so transparency is key