To become a real estate broker, you need a salesperson license, experience (2–5 years), pre-licensing education, broker exam, and a state license. Costs run $1,500–$3,000. Brokers earn $150K+ annually but must manage agents, legal compliance, and client acquisition.

That’s the pathway in simple terms. But the decision to become a broker is about building something bigger: autonomy, leadership, and control over your career.

At Realty Hub, we’ve built a platform specifically for brokers who want to maximize their income while keeping their independence. Our flat-fee brokerage model removes franchise fees, desk fees, commission splits, and unnecessary overhead.

If you want to understand the full journey, including the real-world challenges, financial considerations, and the alternative models that make brokerage ownership far more accessible, keep reading.

Step 1: What a Real Estate Broker Really Does

Becoming a broker means stepping beyond sales into full business ownership. As a broker, you oversee transactions, ensure legal compliance, manage agents, and ultimately run your own firm. You’re responsible for everything from supervising contracts to recruiting and developing new agents.

Your day may involve negotiating commissions, guiding agents through difficult deals, and making leadership decisions that impact your entire operation. While brokers enjoy flexibility and significant income potential, the role demands a shift from simply closing transactions to building and managing an organization.

But here’s the truth many don’t say: You don’t have to start by managing a team. Many brokers operate independently, growing at their own pace without hiring agents immediately. At Realty Hub, many of our brokers choose solo paths while benefiting from our virtual infrastructure that supports growth whenever they’re ready.

Step 2: Meet The Basic Prerequisites

Before you even start your broker journey, make sure you meet the simple but non-negotiable eligibility requirements:

- Be at least 18–19 years old, depending on your state.

- Hold U.S. citizenship or legal residency.

- Have a high school diploma or GED.

Unlike many professional careers, real estate brokerage doesn’t require a college degree. That’s one reason it attracts entrepreneurial-minded individuals from every background. What matters is your ability to complete the licensing process, gain experience, and apply real-world skills once licensed.

Step 3: Gain Experience as a Licensed Agent

Before becoming a broker, you’ll need real-world experience as a licensed agent. Most states require 2–5 years of full-time agent activity. During this time, you’ll need to keep careful documentation of your transactions, often referred to as your transaction log. This record is mandatory when applying for your broker license.

These early years are your training ground. Shadow experienced team leaders, ask questions, observe how successful brokers handle negotiations, client relationships, and problem-solving. The best brokers are excellent leaders because they first learned how the business works at every level.

Step 4: Complete Broker Pre-Licensing Education

Once you’ve gained experience, you’ll move on to broker-specific education. State requirements vary, but most call for 60–270 hours of advanced coursework covering:

- Real estate law and ethics

- Property management

- Investment strategies

- Contracts and advanced agency relationships

For many working agents, online broker courses provide the flexibility needed to complete this education while still managing clients. Expect to invest $300–$600 depending on your course provider and state requirements.

Step 5: Pass the State Broker Exam

Once your coursework is complete, it’s time to take the broker exam, a key checkpoint that tests your readiness to take on legal responsibility in transactions. The exam typically includes 100–150 multiple-choice questions covering both national real estate principles and your state’s specific laws.

To pass, you’ll need a score of around 70–75%. Preparation makes a big difference. Live test prep sessions, flashcards, and practice exams are smart tools to reinforce your understanding and reduce test anxiety.

And if you don’t pass the first time? Don’t panic, most states allow multiple retakes. Failing doesn’t define your future; persistence does.

Step 6: Complete Background Checks & Licensing Application

Once you pass the exam, you’ll submit your fingerprints and undergo a background check as part of your licensing process. You’ll also need to pay an application fee, typically between $150–$300.

Processing timelines vary by state, but don’t be surprised if it takes several weeks. Plan for a delay, and use that window to start thinking about your business structure, marketing plan, or which brokerage model best fits your goals.

Step 7: Decide Your Brokerage Business Model

With your license in hand, you’ll need to choose your operating structure. You can either:

- Launch your own independent brokerage

- Join an existing firm as a managing broker or team leader

From there, your model determines your cost structure and autonomy:

- Full-service brokerage: High overhead, but traditional.

- Flat-fee brokerage: Low-cost model like ours at Realty Hub, $100 per year, $100 per transaction. You keep your full commission and avoid bloated fees.

- Referral-only model: Ideal for those not actively selling but still want to keep their license active and earn from referrals. No MLS, no REALTOR® dues.

There’s a myth out there, pushed by the Realtor association, that “Referral Only” agents can’t do anything but send leads. That’s false. At Realty Hub, we support referral-only brokers who continue to operate profitably without mandatory dues or MLS access.

Step 8: Startup Costs and Ongoing Expenses

You should expect to invest between $1,500–$3,000 to become fully licensed and operational as a broker. These expenses include:

- Pre-licensing education

- Exam fees

- Fingerprinting and background check

- E&O insurance

- Business registration and startup tools

On top of that, you’ll face ongoing costs like MLS access, marketing tools, association fees (if you choose), and office software, unless you join a virtual brokerage like Realty Hub.

Many new brokers wonder: Is this worth it? When the average broker earns over $158,000 a year, the answer is yes, as long as you manage your expenses and pick a model that aligns with your income goals. Our flat-fee model gives agents more room to grow by minimizing overhead from day one.

Step 9: Build Your Brokerage Business

This is where your broker journey shifts from theory to action. Whether you’re starting solo or scaling a team, you’ll need the infrastructure in place:

- Craft a detailed business plan: services, pricing, markets, and revenue goals.

- Build a personal brand that clients remember, your name, your look, your message.

- Set up your online presence: website, CRM system, lead generation tools, and a Google Business Profile.

- If you’re growing a team, establish clear commission policies, compliance systems, and onboarding frameworks.

At Realty Hub, many of our brokers use our backend systems as a foundation while tailoring everything else to their unique brand. That’s how we keep things lean, and why our agents grow faster.

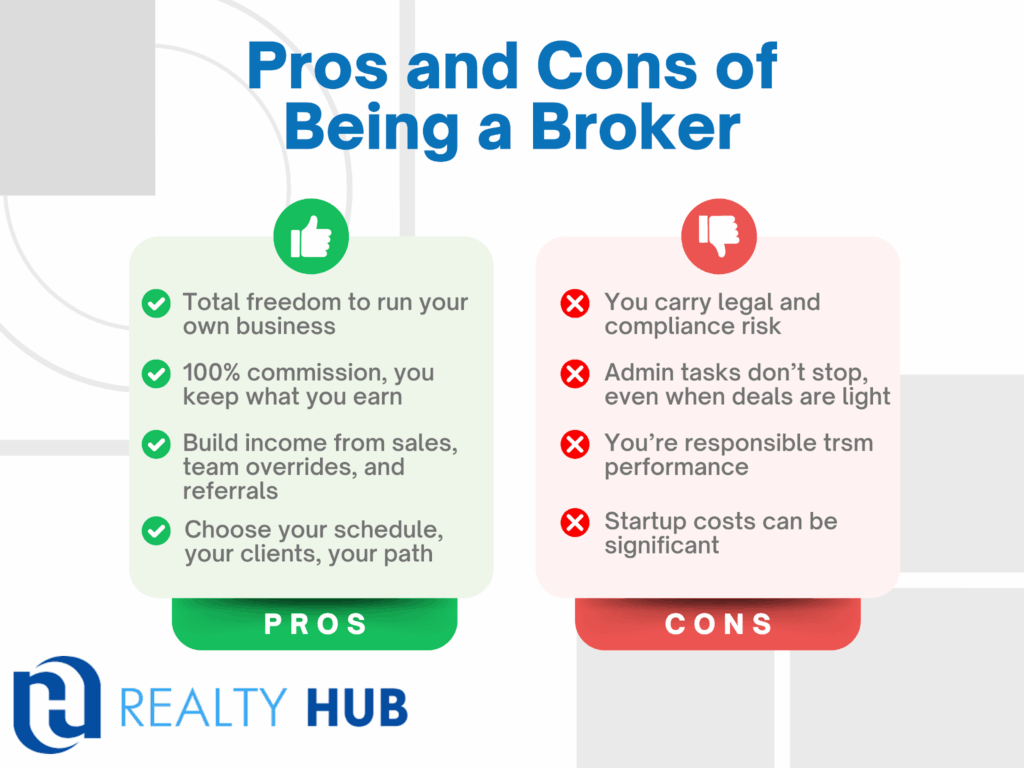

Broker Career: Pros, Cons, and Real Talk

Pros

- Total freedom to run your own business

- 100% commission, you keep what you earn

- Build income from sales, team overrides, and referrals

- Choose your schedule, your clients, your path

Cons

- You carry legal and compliance risk for your business and agents

- Admin tasks don’t stop, even when deals are light

- You’re responsible for the performance of everyone you supervise

- Startup costs can be significant, unless you choose a model like Realty Hub

Insider Tips To Succeed as a Broker

- Find your niche early, luxury, investors, first-time buyers, and own it.

- Use systems from day one for onboarding, compliance, and lead follow-up.

- Only bring on agents you’d trust with your name, their actions impact your license.

- Always carry E&O insurance and know your liability limits.

- Keep overhead low. Our brokers at Realty Hub use our virtual model to scale efficiently without the office bloat.

Is Becoming a Broker Right for You?

If you’re ready to build something, take on leadership, and control your time and income, becoming a broker could be the best decision you’ll make. You’ll have full control, scalable income, and the satisfaction of owning your future.

But if you prefer staying in production without the added responsibilities, you might consider a high-producing agent path instead. Either way, knowing your options is the first step.

Ready to Become a Broker? Let’s Make It Simple

You don’t need another vague promise. You need a model that actually works.

Realty Hub was built for brokers who want:

- Zero commission splits, keep 100% of what you earn.

- Low overhead, just $100 per year + $100 per transaction.

- Total freedom, no quotas, no forced meetings, no hidden tech fees.

Whether you’re just earning your broker license or ready to launch your firm, we’ll give you the infrastructure, compliance tools, and support to build your business on your terms.

If you’re serious about scaling without sacrificing your time, money, or freedom, we’re the platform behind the broker.

👉 Join Realty Hub today or book a call to learn how we can support your next move.

Common Questions New Brokers Ask

Do I need to join the National Association of Realtors?

No. While NAR membership offers some tools and networking, it’s completely optional. At Realty Hub, we support agents who choose not to join, and many save thousands annually by opting out.

Can I work part-time as a broker?

Absolutely. Many of our agents run referral-only or part-time brokerages with low overhead, full compliance, and consistent income.

What happens if I don’t get clients right away?

You’re not alone, it happens. Start with your sphere of influence, join accountability groups or coaching programs, and explore joining a team temporarily. At Realty Hub, we encourage you to pace your business your way.

What about real-world training? The exam barely teaches actual sales skills.

Correct. The exam prepares you for law and compliance, not closing deals. That’s why real-world experience, peer support, and ongoing education are critical once you’re licensed.